License & Insurance Disclosure

Definition of terms

Benefit Member means a person who has applied for and been accepted as a member of Foresters and is an insured under an applicable in force life insurance offered by The Independent Order of Foresters, or one who is registered as a Non-Voting member. Only members 18 years of age and older can register to MyForesters.com.

Foresters engages various professionals in the course of our business, serving our members and other customers, and sponsoring or participating in community activities. In doing so, we are committed to conducting business with integrity and in full compliance with both the letter and spirit of all the laws and regulations that govern our business.

Foresters uses a variety of social media channels, such as Facebook, Instagram and LinkedIn, to engage and communicate with various audiences and share our good works. All news releases are prohibited from engaging in any communication on behalf of Foresters that is false, misleading or harmful. We demonstrate good character, are open-minded and value the opinions, styles and backgrounds of others. We are honest, open and trustworthy.

Code of Ethics (Updated 2023)

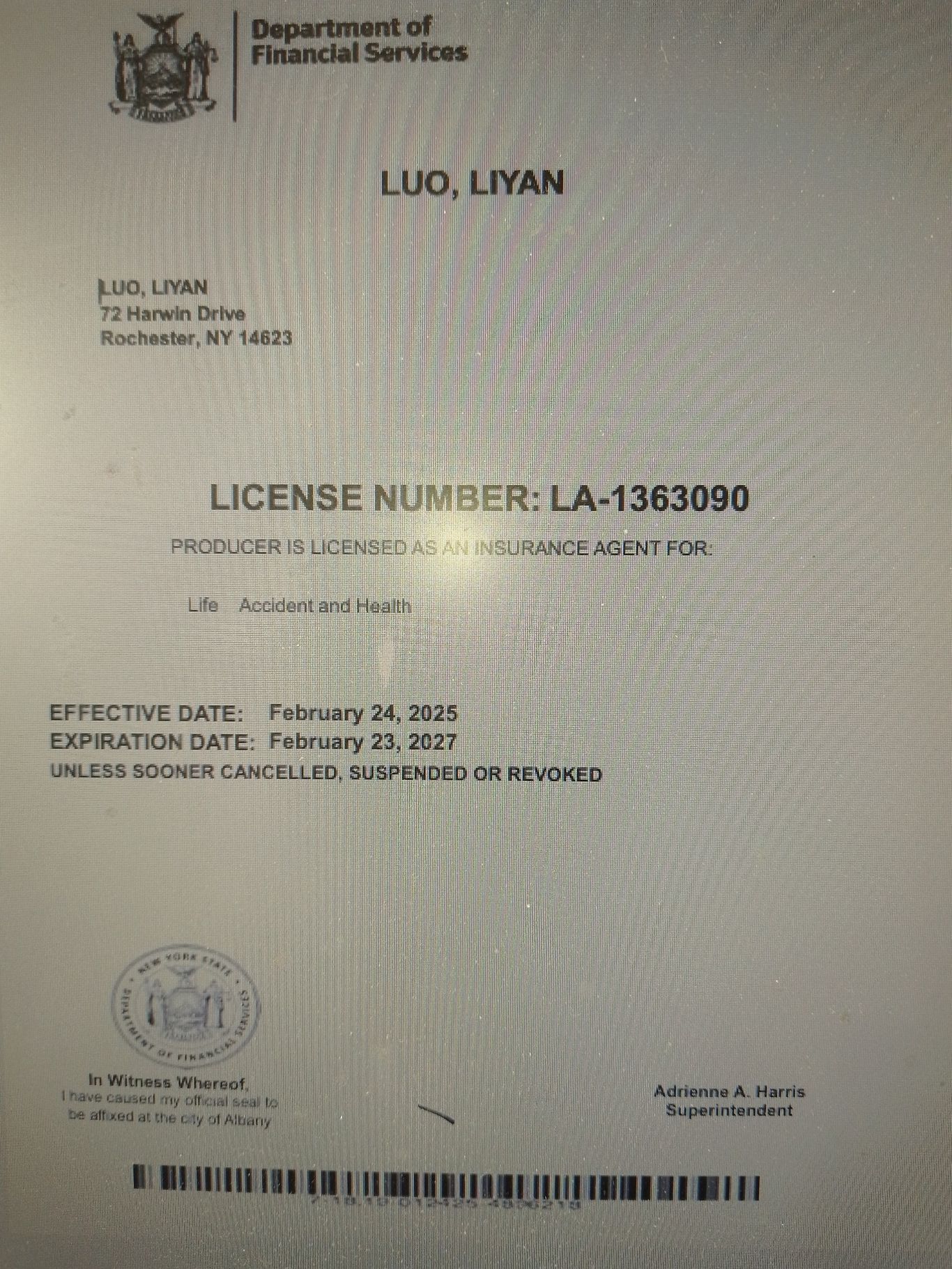

Insurance License

Luo, Liyan; producer is Licensed as an Insurance Agent for Life Accident and Health License Number: LA-1363090 issued by New York State Department of Financial Services since 2016.

Insurance License issued by Illinois State Department of Insurance

License Type: Insurance Producer

Lines of Authority: Health Life

National Producer Number 17517638

LOA Effective Date: 07/24/2020

Exist March 1, 2024 to February 28, 2026

Renew March 1, 2026 to February 29, 2028

Contact@theinsuranceplan.online

DBA Business Insurance

Hartford Accident and Indemnity Company since 1913

Effective Date 3/16/2025 - Expiration Date 3/16/2026

Renew Effective Date 3/16/2026 - Expiration Date 3/16/2027